How to Calculate Your Restaurant's Prime Cost

Prime costs are the sum of the total cost-of-goods-sold (COGS) and the total labor costs. Learn why it's a critical financial and operational restaurant metric and how to track it.

Justin GuinnAuthor

Restaurant Cost Control Guide

Use this guide to learn more about your restaurant costs, how to track them, and steps you can take to help maximize your profitability.

The restaurant industry has tons of different costs that impact the bottom line. And restaurant profits are only influenced by either raising menu prices or lower overhead costs.

That’s why successful restaurant businesses are intentional about taking control of restaurant costs to help sustain profit margins — with no costs more important than restaurant prime costs.

Prime costs are the largest expenses that restaurant management have to navigate. Thus prime cost calculations are a key metric for restaurateurs to monitor.

In this article, you’ll learn what restaurant prime costs are, how to calculate your prime cost number, restaurant accounting and cost control strategies for lowering these direct costs, and the importance of restaurant costing tools rooted in your POS system.

Restaurant Operator Insights Report

See insights from real restaurant operators which can help you benchmark your current and planned restaurant technology stack against your peers as we head into 2024 and beyond.

What are restaurant prime costs?

Restaurant prime costs are the combination of your cost of goods sold (COGS) and your labor costs.

Your restaurant COGS includes food, alcohol & other beverages, packaging, and other costs associated with preparing and serving your menu items.

Restaurant labor costs include salaries, total hourly wages, payroll taxes, employee benefits, health insurance, and more.

These "prime" expenses are directly controllable by restaurant operators and managers — which is why you'll see them also referred to as controllable costs or direct costs. But just because you can control them doesn’t mean it’s easy to control them.

Employee wages and benefits such as workers’ compensation can be hard to tweak, as staffing remains a challenge in the industry.

Lowering food costs can be your easiest way to lower overall restaurant prime costs.

Why do restaurant prime costs matter?

Many operators focus on increasing restaurant sales as the primary lever to grow the bottom line. There’s nothing wrong with this approach — assuming you have ideas for how to increase restaurant sales.

However, it’s really only going to grow revenue. If you’re looking to take control of restaurant prime costs and grow your profit margins, you’re either raising menu prices or lowering food costs.

Restaurant menu pricing strategies as well as menu engineering tactics can help lock in competitive pricing — but for now, let's focus on lowering prime costs.

Here’s the answer why restaurant prime costs matter:

Taking control of and lowering them can help you increase profit margins across all your existing sales.

For example, if your $10 chicken sandwich has a prime cost of $7, you’re walking away with $3 in profits. If you can drop the prime cost to $4 — whether that's through lowering food costs, labor costs, or both — you’ve doubled your profit margin on that dish without touching the price.

Prime cost matters because it presents restaurateurs with a great opportunity to boost profitability across menu items when managed strategically. And it’s this influential across all restaurant types, from food trucks to fine dining to quick-service restaurants.

Toast research highlights importance of controlling restaurant prime costs

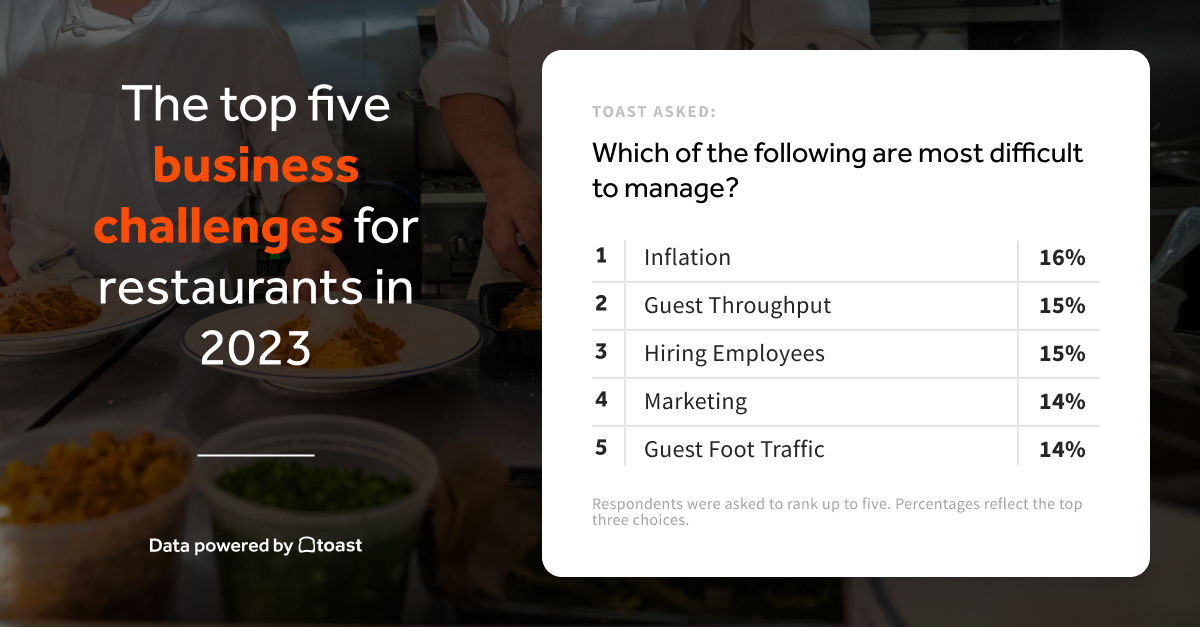

To better understand how restaurants navigate the current climate and their priorities for the future, from May 26, 2023 to June 20, 2023, Toast polled 8471 restaurant decision-makers for its annual Voice of the Restaurant Industry Survey.

Inflation remained the top pain point for restaurant operators for the second year. However, there have been some significant improvements in inventory and employee management, which were the top concerns in our 2022 survey.

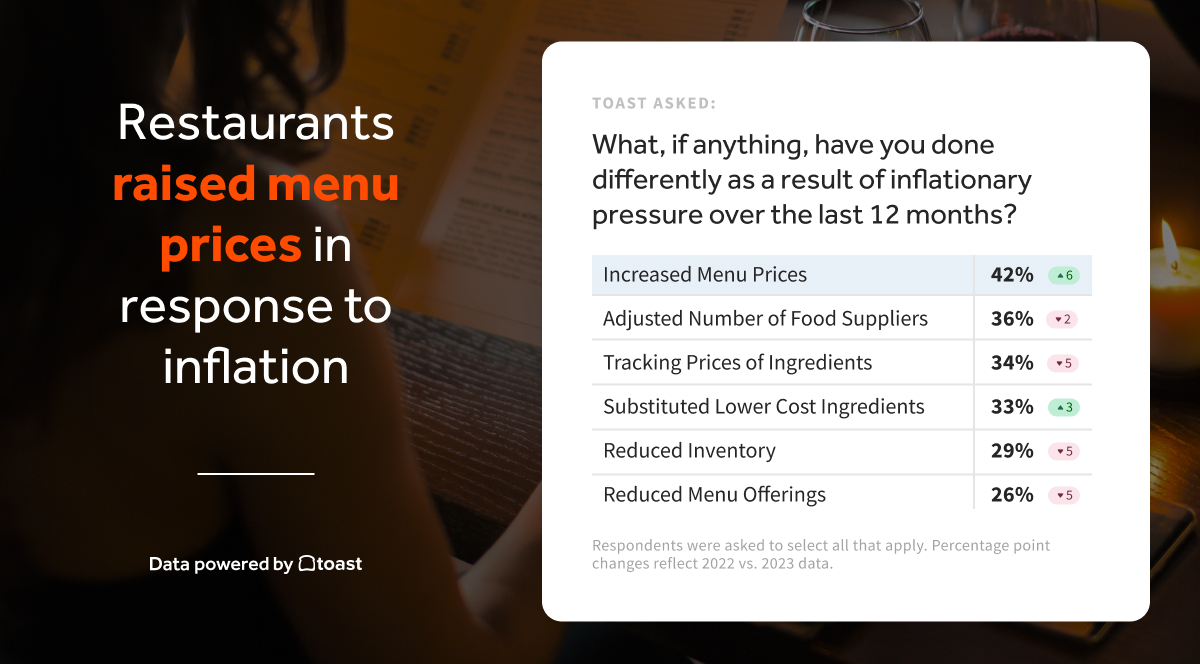

The survey also found that restaurant operators used similar tactics to combat inflation in 2023 as in 2022.

However, 42% of operators we polled say they raised menu prices as a reaction to inflation in the past 12 months, compared to 36% who responded to our survey in 2022.

Respondents also cut costs by shopping different suppliers, tracking ingredients, substituting lower-cost ingredients, and reducing inventory and menu offers.

Take a look at our Restaurant Operator Insights report to get more actionable operational insights as you look to achieve sustainable growth for your restaurant business.

Restaurant Operator Insights Report

See insights from real restaurant operators which can help you benchmark your current and planned restaurant technology stack against your peers as we head into 2024 and beyond.

Calculate restaurant prime cost with multiple prime cost formulas

Again, your restaurant prime cost is the combination of your COGS and your total labor costs. It’s represented by this prime cost formula:

Total COGS + Total Labor = Prime Cost

Total COGS

Total cost of goods sold refers to all ingredients and products purchased for use in your restaurant. We’re talking food costs, beverages, packaging, cleaning supplies—essentially anything regularly used to get your products to customers.

Read our restaurant COGS guide to learn more about calculating COGS.

Total labor

Total labor refers to your labor expenses plus taxes, benefits, food discounts, and insurance. If you pay an employee $10 an hour, it actually costs you closer to $12 or $13 an hour with added costs. Include that total number when you're calculating costs.

Read our labor cost percentage guide for more about calculating labor costs.

Restaurant prime cost ratio

You can get a prime cost ratio by comparing prime cost to your total sales. Here's the equation for prime cost as a percentage of sales:

Prime Cost as a Percentage of Sales = Prime Cost / Total Sales

Let's take a look at this example:

A bakery owner wants to know the prime cost of their business last month. They go over their sales reports and see they had a COGS of $30,000.

Looking over the labor reports, they see that the total labor for their team cost $4,000 for the month. But then they have to factor in taxes, comps, and other benefits, which they estimate will bring costs up to $5,000.

Using the equation explained above, this is now a pretty easy math problem to solve.

Prime Cost = Total COGS + Total Labor

Prime Cost = $30,000 + $5,000

Prime Cost = $35,000

Knowing that the bakery owner's COGS totaled $30,000 and their labor cost, including benefits, totaled $5,000, you just have to add these two numbers together to find their prime cost: $35,000.

If their sales for the month were $60,000, they would use that number to figure out the prime cost as a percentage of sales.

Prime Cost as a Percentage of Sales = Prime Cost / Total Sales

Prime Cost as a Percentage of Sales = $35,000 / $60,000

Prime Cost as a Percentage of Sales = 58%

Advanced restaurant operators can also drill down to the prime cost per individual recipe, menu item, or group of menu items. This allows you to quickly determine the profitability of specific items, which lets you see if prices need to increase or perhaps the item needs to be discontinued.

What is the average restaurant prime cost?

A full-service restaurant’s prime costs are typically around 65% of total sales. A limited-service restaurant’s prime costs are typically around 60% or less of total sales.

The ideal prime cost

As a general industry benchmark, 60% or lower is a good benchmark to aim for—with half attributed to COGS (30%) and half attributed to labor (30%).

If you really want to crush it, shoot for 55%. A prime cost below 50% means you're likely cutting corners in some way, which will only hurt you in the long run.

The best customers are the ones that keep coming back and gaining that loyalty requires you to provide customers with a great experience at a good value.

How to maintain a low restaurant prime cost

If your restaurant is seeing a higher prime cost than you'd like, set a reasonable timeline and measure your expectations by following these steps.

1. Set a goal

Set a target prime cost percentage you want to hit by the end of the year and hold yourself accountable when it comes to meeting that goal.

Instead of saying, "I want a lower prime cost percentage," set a specific, measurable, and attainable goal. Plant a flag and engrain some accountability by saying, "I want my prime cost percentage to decrease from 72% to 60% in the next seven months."

2. Track prime cost components regularly

Tracking COGS and labor cost at least monthly can help you hit target prime cost goals. That way, you don't have to wait a full year to realize you should have adjusted menu prices.

Restaurant invoice processing automation is essential for optimally tracking COGS. This is the only way to automatically track product price fluctuations from your vendors.

With automated invoice management, your staff can simply take a photo of a vendor invoice and upload it. The system automatically pulls line-item pricing and quantity details while rolling up the payables to your chart of accounts.

3. Optimize your inventory management practices

Do the dirty work of detailed inventory tracking — work made much less dirty with the invoice automation tools listed above.

Understanding your beginning inventory and ending inventory over a given period of time is an essential metric for your restaurant business.

Consistently tracking these inventory measures enables restaurant operators to set benchmarks for COGs, food costs, ingredient efficiency, food waste, loss and spoilage, and other metrics.

4. Redesign your menu

Menu engineering can help restaurateurs take advantage of high-impact, impressive items with lower COGS.

If sales are decreasing, maybe it's time to reconsider ingredients or portion sizes for all your menu items. Assuming sales stay the same after you make the change, you may see your prime cost ratio even out.

When reworking your menu, it’s important to consider the food quality of your ingredients. You may have room to lower quality and boost profitability, but lower too much and guests will likely notice.

And if you're not conducting recipe costing and calculating your plate costs regularly, your menu may be suffering from unfavorable profit margins due to increased food costs — which increases your prime costs.

5. Implement restaurant accounting practices

Understanding the unique accounting needs of the restaurant industry can help business owners hone performance metrics and tweak operations. Everything from profit and loss statements to general ledgers and chart of accounts can be uniquely created for restaurants.

A restaurant-specific accountant can help unlock all these nuances and ensure your metrics and reporting are all on point.

Point of sale (POS) system built for restaurants

Your point of sale (POS) system is the foundation of your restaurant technology stack. Its purpose can extend far beyond inputting orders and processing transactions.

Your POS system can unlock tons of cost control and forecasting insights if it has key integrations with invoice processing, inventory management, payroll, employee scheduling, and similar tools.

You can combine sales data from the POS with these COGS and labor cost insights to start making more informed decisions.

Schedule a demo to speak with a product specialist today about the potential benefits of Toast POS, Toast Payroll and Team Management, and xtraCHEF by Toast for your operation.

Related Resources

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.