Article

Interchange Plus vs. Flat Rate Restaurant Credit Card Processing: What’s the Difference?

Let’s cover the basics of restaurant credit card processing, such as what is interchange plus pricing and how does it differ from flat rate?

Restaurant payment processing can be a tricky area to navigate, particularly when it comes to pricing. In this article, we’ll clear up any confusion by providing you with an overview of the differences between the two main payment processing pricing structures: Interchange plus and flat rate.

First, what is credit card processing?

Put simply, credit card processing is the act of successfully completing a payment made with a credit card. This process involves many moving parts, but typically follows this general pattern:

- A customer presents a card for payment

- The card information is sent to the payment processor, which then communications with the customer’s bank or card network (such as Visa, Mastercard, or Discover)

- The issuing bank approves or denies the transaction, based on certain criteria (i.e. availability of funds, whether the card is valid, suspicion of the transaction being fraudulent, etc.)

- The payment processor receives the approval or denial, which is then sent back to the credit card reader or point of sale (POS) system

- Once a transaction is approved, it is added to a batch. A batch is simply a group of transactions that have been processed but have not yet been paid out

- A batch of credit card payments is closed and submitted, typically at the end of each day, for processing

- The customer’s account is charged for the transaction and the money is deposited into the business’ bank account

All businesses, including restaurants, must have payment processing set up in order to receive payment from customers. One of the factors that can determine which payment processor to go with is what rate structure they provide. In other words, the rates and fees you’ll pay to receive payment from customers or guests. Two popular rate structures are interchange plus and flat rate.

What is interchange plus pricing?

The interchange plus model, also known as IC+, involves paying the interchange and network costs of each card that your restaurant accepts, along with a fixed markup that your processor takes in as net revenue.

But, how does interchange plus work? There are two elements that make up interchange plus pricing:

- Interchange: This is the fee that comes directly from the card networks, such as Visa or Mastercard. These rates are not controlled by payment processors and every merchant is required to pay the interchange.

- Plus: This is the fixed markup that a credit card processor charges on top of the interchange fee. This typically includes a percentage fee and a transaction cost.

Although interchange and network costs vary with each specific card your guests use, the separation of these fees from your processor's markup provides increased transparency into what you’re actually paying for.

What is flat rate pricing?

The flat rate pricing model involves charging one simple rate for each transaction your restaurant processes, no matter what type of card is used. This means that, as long as your sales and average ticket don’t fluctuate significantly month-to-month, your costs will remain relatively constant and predictable.

Let’s delve deeper into each payment processing structure, with an example at the end to help illustrate the key differences.

The basics of interchange plus

Interchange plus is a cost-plus pricing model that starts with a base of interchange fees and network fees; together, these fees are sometimes referred to as the “inherent cost” of card processing because your payment processor must pay these fees regardless of which pricing structure you choose. Your payment processor then adds its markup for providing its services (the “plus”) on top of these fees. Here’s a brief description of each of these components:

- Interchange fees make up the bulk of processing fees. They’re set by card networks, such as Visa and Mastercard, and are paid to the bank that issued the card that is used for each transaction.

- Network fees are set by card networks and are paid to the card network. These fees differ based on card brand, card type, and other factors, similar to the variances seen with interchange fees.

- The processor’s markup is layered on top of the Interchange fees and typically includes a volume fee (a percentage) and a per-transaction fee.

Each card brand and card type is associated with different interchange fees and network fees; in fact, there are hundreds and hundreds of card-specific fees that further depend on a variety of characteristics, such as whether the card is a debit card or credit card, regulated or unregulated, rewards or traditional, and more. Interchange and network fees can change twice a year, and they’re publicly available. For example, you can see Visa’s rates detailed here.

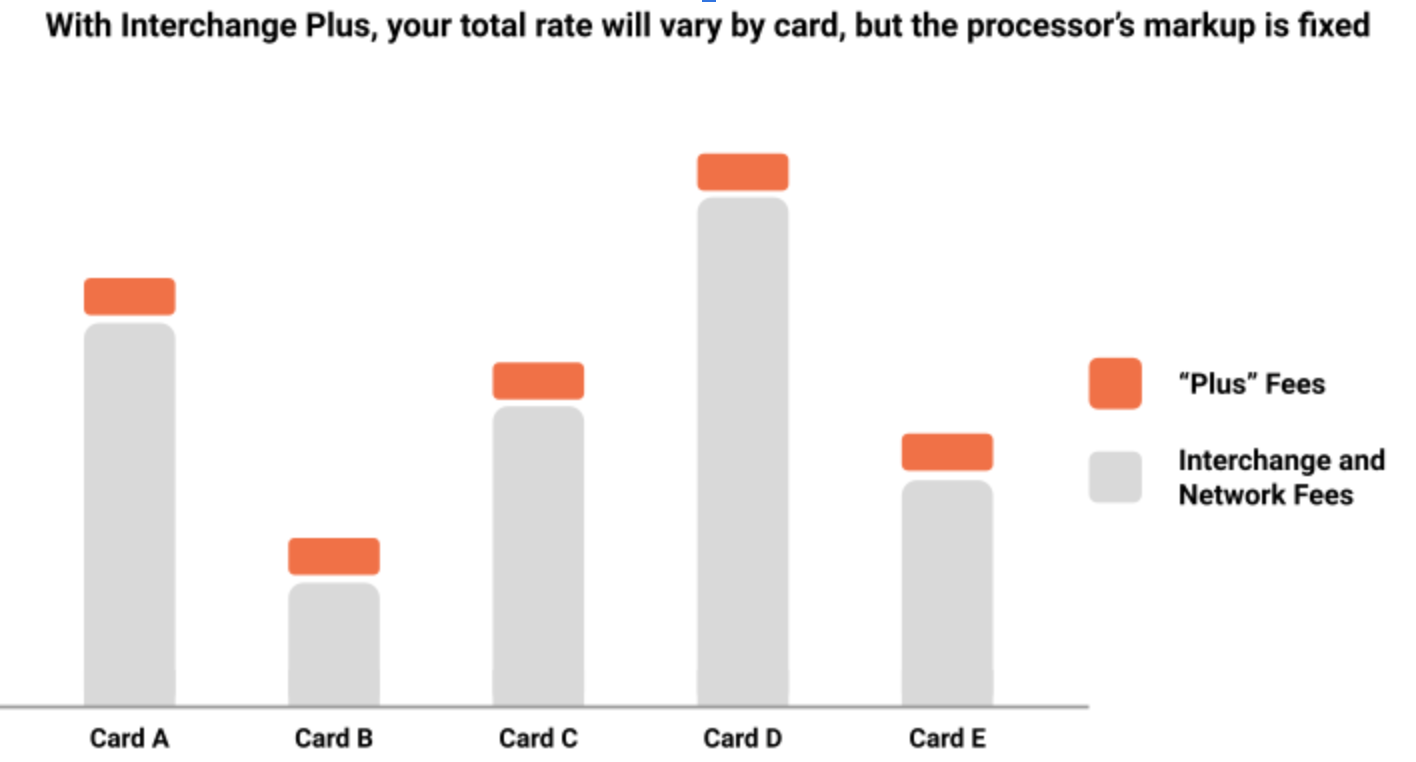

Take a look at the graphic below, which shows the varying Interchange card costs in grey and the markup associated with Interchange Plus in orange. Your restaurant will pay the combined amount of the interchange fees — which vary from card to card — and the “plus” fee.

While the interchange rate may fluctuate depending on card type, the markup, or “plus” fee (the processor's profit), is a fixed percentage and/or a per-transaction fee for every sale. Though interchange rates differ depending on the variety of cards your guests pay with, an interchange plus pricing model provides you with strong transparency into your processing fees by separating interchange fees from the margin it collects for providing its services.

The basics of flat rates

Flat rate payment processing means your restaurant is charged straightforward flat rates for every card your restaurant comes across, regardless of card type. Generally, the only thing that affects your flat rate is the type of transaction that is being processed. In most cases, there will be one flat rate for card-present transactions (physically swiped, dipped, or tapped), and a separate flat rate for card-not-present transactions (keyed-in or online).

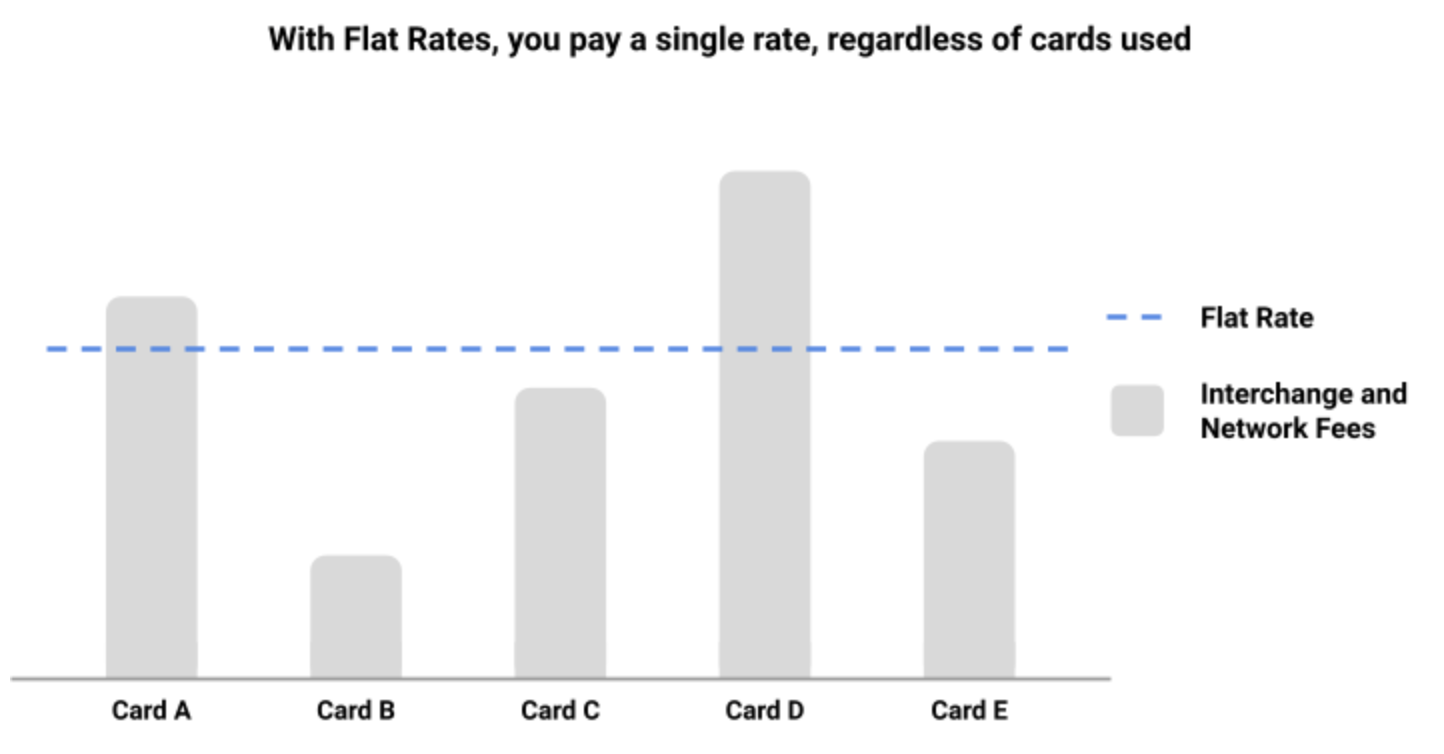

With this model, you don’t need to worry about any interchange rates or markups, just this one simple flat fee — you’ll know exactly what rate you’re paying from period to period. Meanwhile, your payment processor takes care of paying for the inherent cost associated with processing each card, regardless of whether your flat rate is above or below the fees that your processor pays on your behalf.

With so many fluctuating variables in your restaurant, it can be comforting to know that you’ll be able to predict your payment processing fees. Check out the graphic below, which depicts how a flat rate model works, highlighting its simplicity.

Choose what works best for your restaurant

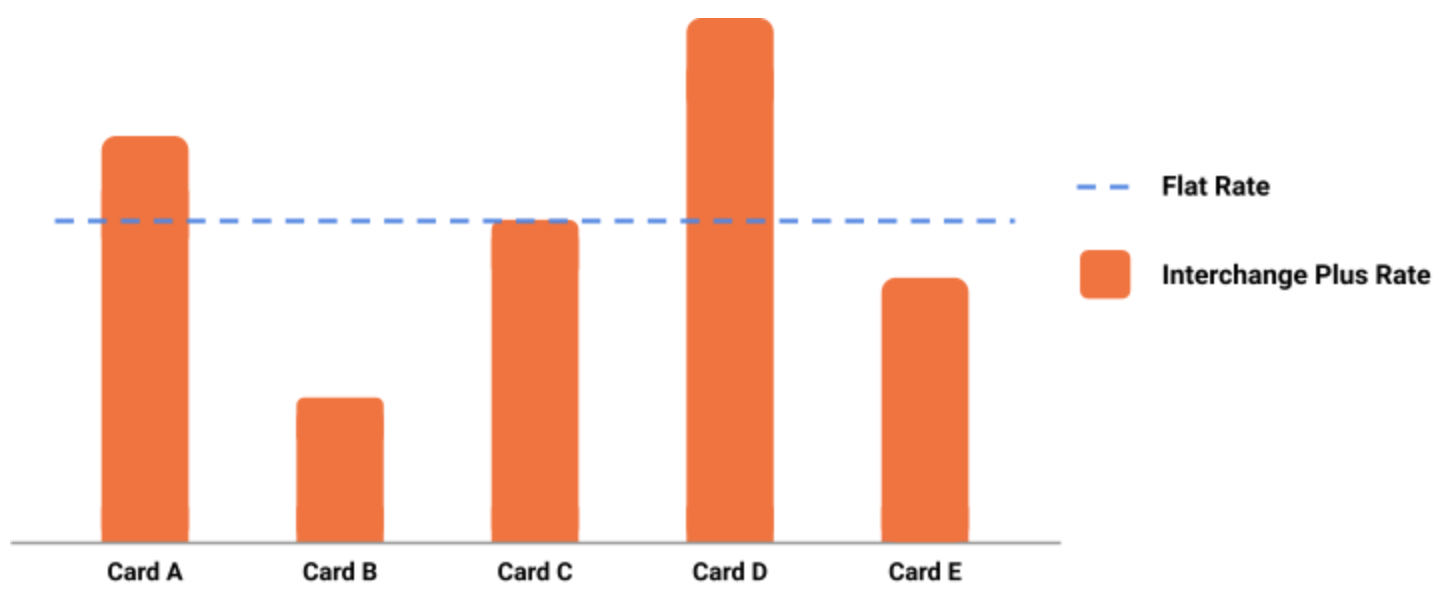

Since we’ve taken a look at how interchange plus and flat rate pricing work separately, let’s put them together to see exactly how their rates can differ.

In the chart above, we can see how the flat rate stays steady for each card while the interchange plus rate fluctuates depending on what kind of card is used. In certain cases, your overall processing fees on an interchange plus structure may be higher, lower, or about the same as the flat rate structure.

To summarize, interchange plus and flat rate are both valid and popular pricing structures, but they both offer their own unique value propositions. A Flat Rate structure offers greater clarity and simpler forecasts since you're paying the same steady rate for each transaction. As for an interchange plus structure, you receive greater transparency into your processing costs, which can help you evaluate the cost you’re paying for the services that your processor provides to you.

Some processors manage to find ways to insert hidden fees into their credit card processing fees, regardless of the pricing structure. These fees can range from reporting fees, PCI non-compliance fees, fraud prevention fees, and even a fee to get your statement. However, here at Toast, those features and many more are all included in your processing rate at no additional cost. Our goal is to provide a clear and transparent processing rate ー no hidden fees, no bait and switch, and no unexplained line items in your statement.

One size does not fit all when it comes to pricing structures. When researching providers for your small business, keep these lessons in mind.

Request a demo today and speak with one of our restaurant technology specialists to discover which structure is best for your restaurant.

Related Resources

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.